- May 9, 2025

The Most Cost-Effective BNPL Solutions for SMB Accounting Firms

- Marc Howard

As a tech entrepreneur I spend a lot of time researching tools that can help small and medium-sized accounting firms thrive. One trend that’s caught my eye is Buy Now, Pay Later (BNPL)—a payment solution that lets clients pay for services like tax prep or audits in installments while firms get their money upfront.

It’s a brilliant way to attract clients and keep cash flow steady, but the costs can add up if you pick the wrong provider. So, I did a bit of digging and compared five top BNPL players—Bill.com with Hokodo, CPACharge Pay Later, QuickFee, Stripe with Zip/Sunbit, and Practice Ignition with Klarna—to find the most cost-effective option for SMB accountants.

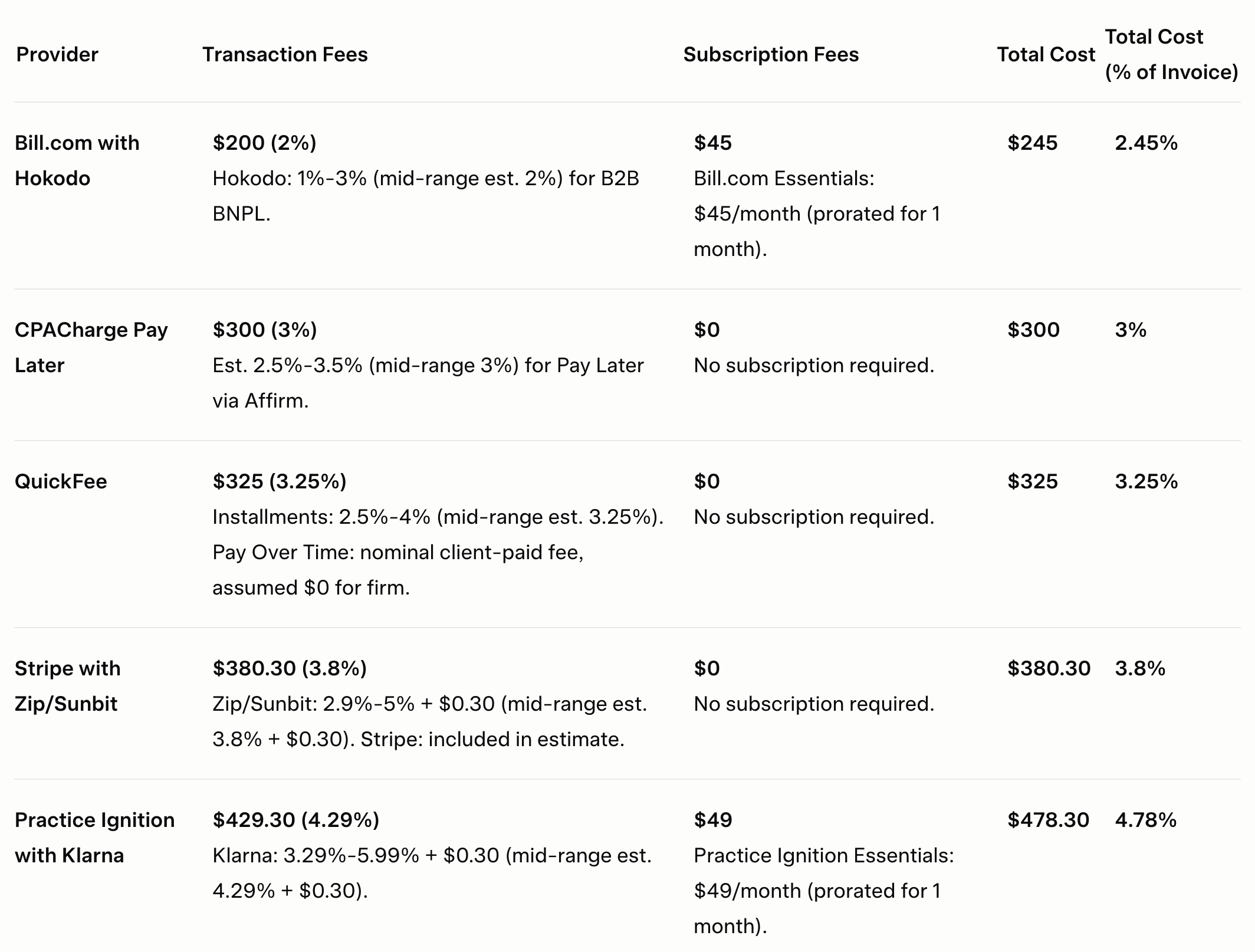

I focused on a $10,000 invoice (think a big audit or advisory gig) to see what each would cost. Here’s the scoop, with a table to make it crystal clear.

Why BNPL Is a Game-Changer for SMB Accounting Firms

If you’re running a small accounting firm, you know clients sometimes hesitate to commit to big-ticket services because of upfront costs. BNPL solves that by letting them spread payments over weeks or months—say, for a $10,000 audit—while you get the full invoice amount right away. No more chasing late payments or stressing about cash flow. The rub is that each BNPL provider charges fees, and those can chip away at your margins. As someone who’s been digging into solutions for firms for years, I wanted to find the provider that keeps costs low without sacrificing ease of use.

Breaking Down the Top Five BNPL Providers

To make this comparison fair, I looked at a $10,000 invoice—a typical size for a major engagement—and calculated the total cost for each provider, assuming the firm absorbs the fees (though most let you pass them to clients). I focused on two main costs: transaction fees (the percentage or fixed fee per invoice) and subscription fees (monthly costs for platforms like Bill.com or Practice Ignition).

I assumed the invoice is processed online, and for providers with subscriptions, I prorated the lowest-tier plan for one month. The table below is sorted by total cost, from lowest to highest, so you can see which option saves the most:

What Jumps Out?

Bill.com with Hokodo is the cheapest at $245 (2.45%), thanks to a lean 2% transaction fee. The $45/month subscription isn’t a big deal for a $10,000 invoice, especially if you’re already using Bill.com for accounts payable or receivable. It’s a great fit for firms working with B2B clients.

CPACharge Pay Later comes in at $300 (3%) with no subscription fees, which is awesome if you want to avoid recurring costs. If your firm is already using CPACharge, this is a low-hassle option, especially for individual clients.

QuickFee is close at $325 (3.25%), also subscription-free. I like that it offers both short-term (four interest-free payments) and long-term (3-12 months) plans, giving you flexibility for different clients.

Stripe with Zip/Sunbit costs $380.30 (3.8%), which is okay for tech-savvy firms with online portals, but the higher transaction fee makes it less appealing than CPACharge or QuickFee.

Practice Ignition with Klarna is the most expensive at $478.30 (4.78%), hit by a steep 4.29% transaction fee and a $49/month subscription. It’s tough to justify unless you’re already locked into Practice Ignition.

What This Means for Your Firm

For a $10,000 invoice, the gap between the cheapest (Bill.com at $245) and the priciest (Practice Ignition at $478.30) is $233.30—that’s real money for a small firm. Transaction fees are the biggest factor, especially for bigger invoices. Bill.com’s 2% fee saves a ton compared to Practice Ignition’s 4.29%. But if you’re allergic to subscriptions, CPACharge and QuickFee are super close, with just a $25 difference.

Providers like CPACharge, QuickFee, and Stripe, with no subscriptions, are great for firms that don’t use BNPL all the time. You only pay when you process an invoice, which keeps things flexible. Bill.com’s subscription might be worth it if you’re handling multiple invoices a month, as that low transaction fee adds up to serious savings.

My Recommendations

After crunching the numbers, here’s how I’d guide SMB accountants choosing a BNPL provider:

Pick Bill.com with Hokodo if you work with B2B clients and use Bill.com already. At $245 (2.45%), it’s the cheapest, and the subscription pays off for regular BNPL users.

Go for CPACharge Pay Later if you want no subscriptions and a solid 3% cost ($300). It’s perfect for firms serving individual clients and already on CPACharge.

Choose QuickFee if you need flexibility for both individual and B2B clients. The $325 (3.25%) cost is fair, and no subscription means you only pay when you use it.

Skip Practice Ignition with Klarna unless you’re tied to their platform. The $478.30 (4.78%) cost is a budget-killer for most small firms.

Consider Stripe with Zip/Sunbit only if you’re building a custom online portal and can handle the $380.30 (3.8%) fee. It’s not as accounting-focused as the others.

Wrapping Up

BNPL can be a game-changer for SMB accounting firms, making your services more affordable for clients while ensuring you get paid upfront. But costs matter, and picking the right provider can save you hundreds per invoice. Bill.com with Hokodo leads the pack for a $10,000 invoice, but CPACharge and QuickFee are great subscription-free options. As someone who’s been digging into these tools for firms like yours, I’d say look at your client mix, invoice sizes, and whether subscriptions fit your budget.

NEW: Download the "Moneyball Method" to Grow Your Firm

Client Profitability Scorecard

Enter in your clients and the worksheet advises on which clients should be "benched", "traded" and who to keep in your starting line-up. It helps you fine tune your niche by finding similar "A" and "B" clients.