The Accounting Firm Owner's Guide to Production-Based Pay Structures in Public Accounting

Public accounting firms in the United States increasingly use production-based pay structures – compensation tied to measurable outputs like billable hours, revenue generated, or project completion.

This guide breaks down how these pay structures work across different firm types and sizes, key accounting roles, and emerging trends.

We focus on U.S. public accounting (with some niche sectors like manufacturing accounting) and use verified industry data for a clear picture of salaries, bonuses, and incentives.

Firm Types and Size Categories in Public Accounting

Public Accounting Firm Categories: Public accounting firms range from small local practices to large national and global firms. Size is often measured by staff count or revenue:

- Small Firms: Local CPA practices or boutique firms (few dozen employees or less).

- Mid-sized Firms: Regional or niche firms (tens to a few hundred employees).

- Large Firms: National firms and the Big Four (thousands of employees worldwide).

- Enterprise Level: The Big Four (Deloitte, EY, KPMG, PwC) are often in a class of their own due to their scale and resources.

Compensation Approach by Firm Size: Pay structures can differ by firm size:

- Big Four vs. Others: Big Four firms tend to pay 5–15% higher base salaries than mid-size regional firms for comparable roles. They compete nationally for talent and have high billing rates, supporting higher pay.

- Mid-size & Regional Firms: Often offer competitive salaries but slightly lower than Big Four. They may use bonuses to reward high billable hours or new client revenue to compensate ambitious staff.

- Small Firms: Compensation can be more varied. Some small firms offer lower base salaries but higher revenue-sharing or commission-like bonuses (e.g. a percentage of the billable revenue an employee generates). For example, some practitioners report arrangements like 40% of billings paid to the accountant as compensation (after an initial draw) – effectively aligning pay directly with production (anecdotal evidence). Other small firms may simply pay a market-rate salary with modest or no bonuses.

Niche Sectors (e.g. Manufacturing Accounting): Accountants in industry sectors like manufacturing (often management or cost accountants) aren’t in public practice but have analogous incentive structures. For instance, a cost accountant in manufacturing might earn a base salary similar to public accountants of equivalent experience (around $75k–$80k on average). Their bonuses may tie to cost-saving projects or efficiency improvements (a form of project-completion bonus) rather than billable hours. In highly profitable manufacturing firms, cost accountants can receive profit-sharing or performance bonuses that push total pay over six figures. However, unlike public firms, their “production” metrics relate to internal targets (like meeting budget goals or project deadlines) instead of client billings.

Roles and Specializations – Pay Structure Insights

Compensation is also differentiated by role within public accounting and, in some cases, by specialization. Below we outline common roles and how production-based pay components come into play:

- Audit/Assurance Accountants: Auditors (staff through senior manager) typically have a base salary and are expected to log high billable hours, especially during busy season. Some firms pay overtime or bonus for hours exceeding a threshold (e.g. a set bonus for hitting 1,700 chargeable hours in a year). At the partner level, audit professionals often receive bonuses tied to the overall engagement profitability or client retention in addition to base pay.

- Tax Accountants: Tax associates and managers also face seasonal workloads. It’s common to see two annual bonuses in tax departments – one after the April 15 filing rush and another after the Oct. 15 extension deadline – as a way to share profits and reward the heavy overtime in those periods. High performers might get extra bonus for exceeding billable hour targets or for bringing in new clients. However, some tax accountants in consultative roles may shift to value pricing (fixed fees per project) rather than hourly billing, which can influence how bonuses are determined (focus on project completion and client satisfaction rather than pure hours).

- Managerial/Cost Accountants: These roles (often in industry or specialized consulting) focus on internal financial management, cost control, and analysis. In public firms, “managerial accounting” services may be offered to clients (outsourced CFO services, etc.), where fees could be fixed-price. Pay for managerial accountants usually emphasizes base salary plus a performance bonus tied to meeting budget goals or project milestones. For example, a managerial or cost accountant in industry might have a base salary around $77,000 (U.S. average) with additional bonus of 5–15% for hitting cost-saving targets. In niche consulting projects, a project completion bonus may be awarded if a project is finished under budget or ahead of schedule to reward efficiency.

- Specialized Positions: Certain specialties command higher pay and often have unique incentive structures:

- Forensic Accountants: These experts investigate fraud and litigation matters. They typically earn 15–30% above average public accounting salaries due to specialized skills. Their bonuses might tie to project success (e.g. uncovering fraud in a big case) or utilization rates, but since their work is project-based, completion of a large investigation can lead to a notable performance bonus.

- International Tax Specialists: They deal with cross-border tax issues and can earn 10–25% more in base pay than general tax accountants. Firms value the revenue these specialists generate from multinational clients, so pay packages often include higher base and sometimes additional bonuses for handling complex global projects or obtaining advanced credentials.

- IT Auditors and Advisory (Tech Specialists): With more firms offering IT audit, cybersecurity, or data analytics services, accountants in these niches may see premium pay and bonuses for certifications (e.g. CISA, CITP). While exact figures vary, their compensation often includes incentives for completing high-value projects (like a systems audit or a data analytics implementation) on time.

Base Salaries Across Firm Sizes and Roles

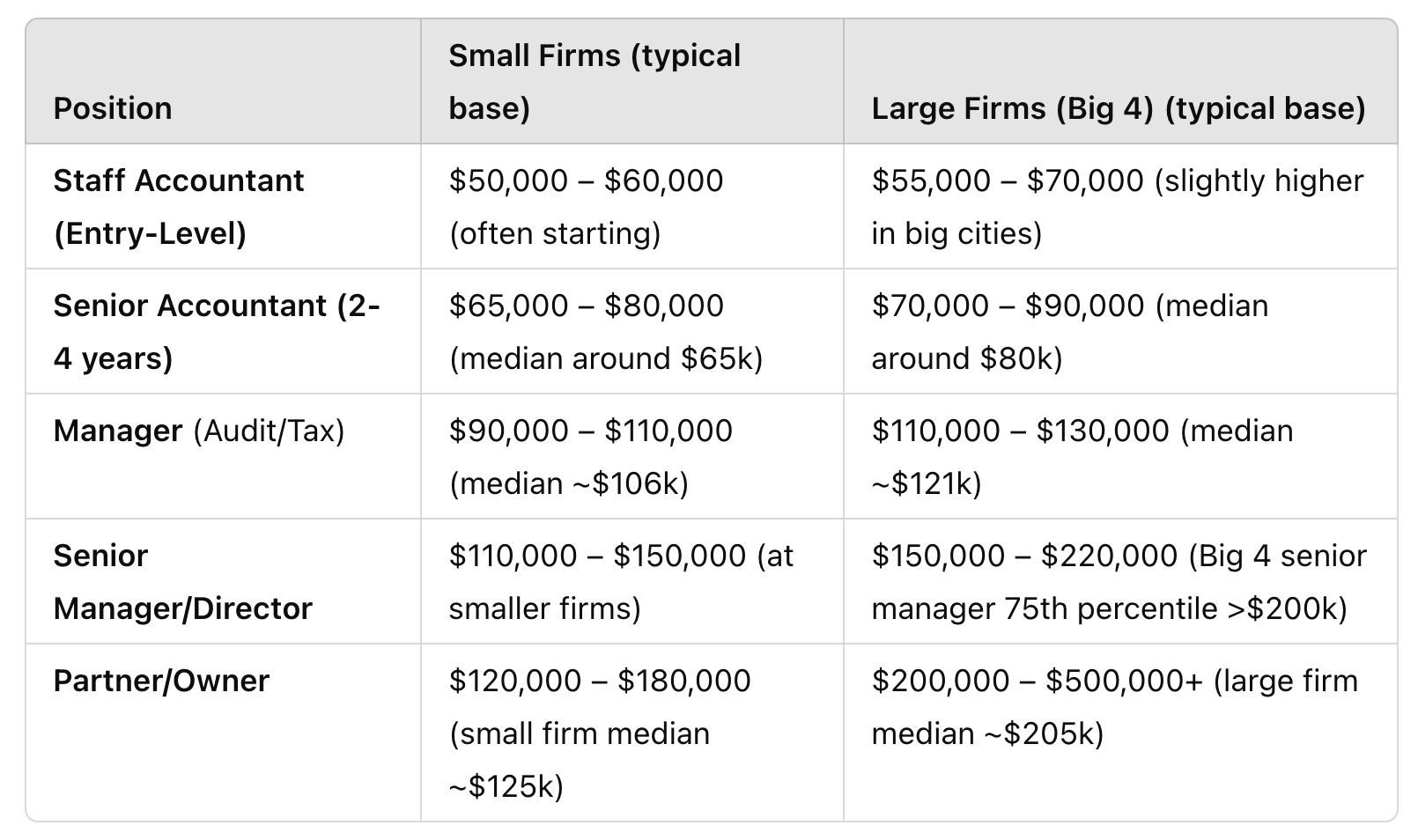

Base salary is the foundation of compensation. Here’s a snapshot of base salary ranges in public accounting, by role and firm size, illustrating how firm scale impacts pay:

Sources: These ranges are drawn from salary surveys and guides. For instance, Accounting Today’s 2024 survey found a staff accountant median salary ~$65k and senior ~$88k across firms. Managers showed a jump, especially at large firms (median ~$120k). Big Four senior managers and directors often cross $150k, and partners commonly earn well into six figures, with large firm equity partners averaging around $200k+ (and many in the high six or seven figures when including profit shares).

Regional cost-of-living also plays a role: major metros like New York, San Francisco, or Los Angeles see salaries 10–20% above national averages, whereas smaller cities might be at or below the national norms.

Production-Based Pay Components

Beyond base salary, public accounting compensation often includes variable components directly tied to performance. Key components include:

- Billable Hours Bonuses: Many firms set a yearly billable hours target (e.g. 1,800 hours for staff). Exceeding the target can yield a bonus or additional pay. For example, one firm offers a $7,500 bonus for hitting 1,700 chargeable hours for staff/supervisors (with a slightly lower threshold for managers). This directly rewards those who work more client-billable time. Some firms without formal overtime pay use this kind of bonus to compensate long hours during busy season.

- Revenue-Sharing / Commissions: In some compensation models, especially in smaller or mid-tier firms, accountants receive a percentage of the revenue they generate. One survey respondent’s firm gave “staff who are primary on a client 10% of collections annually”. Similarly, a common benchmark in practice is to target salary at roughly 1/3 of billings (for example, paying someone about one-third to forty percent of what their work bills to clients) – effectively a commission-like structure. Partners almost always have revenue-sharing: their income is largely a function of firm profits, which in turn come from billable work and clients brought in.

- Project Completion Bonuses: Though less common in traditional audit/tax, some firms (and many consulting practices) reward successful completion of major projects. For instance, an accounting firm might give a completion bonus for finishing a large client audit ahead of deadline or under the budgeted hours. In other environments like manufacturing, an accounting manager might get a bonus for implementing a new cost system by year-end. The key is tying a reward to finishing a project that delivers value. In project-oriented accounting engagements (like advisory projects), firms ensure performance metrics are measured at project completion to calculate these bonuses – ensuring the team is rewarded only if the project meets its financial and quality goals.

- New Business or Client Origination Bonuses: Public accounting firms often encourage bringing in new clients. It’s not unusual to see a 10–20% bonus on first-year fees for the employee who referred or landed a new client.. For example, if a staff member brings in a client that pays $50,000 in fees, they might get a $5k–$10k bonus. This incentivizes practice development even at junior levels (though in practice, partners and managers are more likely to be involved in sales).

- Profit-Sharing and Firm Performance Bonuses: Many firms distribute a year-end profit-sharing bonus if the firm meets its financial targets. Staff might get a flat percentage of salary (say 5-15%) based on overall firm profitability. For instance, a common approach is targeting around 10% of base salary as a bonus for solid performance in profitable years. At the partner level, this is often a significant portion of pay (the “bonus” may actually be their share of remaining profits after paying base salaries/draws).

- Benefits and Perks: While not tied to “production,” benefits form an important part of total compensation. Most public accounting firms provide:

- Health and Retirement: Comprehensive health insurance, 401(k) plans often with employer match, and sometimes profit-sharing retirement contributions.

- Paid Time Off: Generous PTO, especially after busy season, and paid holidays. Some firms offer extra PTO as a reward for high performance or as a compensation for heavy overtime (e.g. “spring break” week off after tax season).

- Continuing Education and Certification Bonuses: Many firms pay for CPAs’ continuing professional education and exam fees. It’s common to give a bonus for earning the CPA license – often a lump sum (e.g. $5,000) or a raise of 5-10%. Some firms explicitly tie a raise to CPA completion (one firm cited an immediate 15-25% salary bump when an accountant becomes certified).

- Flexible Work Arrangements: Not a cash component, but increasingly offered. For example, after the pandemic, some firms let staff trade some bonus or pay for a reduced work schedule, or vice versa, recognizing work-life balance as part of the “compensation” equation.

Market Trends Influencing Pay Structures

The accounting profession in the U.S. is experiencing forces that shape how firms structure pay:

- AI and Automation: The rise of AI tools and automation is transforming accounting work. Routine tasks (data entry, basic reconciliation) are increasingly automated, which means entry-level roles evolve to focus on higher-value work. Rather than cutting pay, firms are shifting expectations – junior accountants need to handle analysis and advisory sooner. Those who acquire tech skills (data analytics, AI tools) can command higher salaries or bonuses. Automation is seen as augmenting accountants, not replacing them. In terms of pay, some firms reward employees who champion efficiency (for example, implementing a new AI-based audit technique that saves hundreds of hours might result in a special bonus or faster promotion). Over time, we may see fewer roles compensated purely by hours worked and more by outputs achieved (e.g. process improvements, insights delivered), thanks to automation streamlining the hours required for basic tasks.

- Talent Shortage and “Vibecession” Sentiment: Despite mixed economic vibes (the so-called “vibecession,” a period of economic pessimism despite solid fundamentals), accountants are in high demand. A large number of U.S. accountants have left the field or retired in recent years, creating a talent shortage. Firms are responding by raising starting salaries nearly 9% on average for 2024-2025. For example, Robert Half data shows public accounting starting salaries jumping ~8-10% in a year for both tax and audit roles. Even uncertain economic sentiment hasn’t dampened the need for accounting expertise – if anything, firms feel pressure to sweeten pay packages (bonuses, remote work options, student loan pay-down benefits, etc.) to attract new hires. Some managers are offering up to 20% higher pay for employees willing to work in-office, underlining how competitive the market is.

- Work-Life Balance and Burnout Considerations: The demanding hours in public accounting have long been a concern. In recent years, trends like “quiet quitting” and younger professionals prioritizing balance have pushed firms to adjust pay structures. For instance, more firms now pay for every extra hour (straight overtime or bonus) to acknowledge staff efforts, rather than expecting unpaid overtime. Others cap hours and instead shift to value pricing models to decouple hours from revenue, which in turn can stabilize workloads. While base pay is rising, firms also experiment with perks like extra time off, casual office environments, and better benefits as part of the compensation package to retain talent. This indirectly ties to production: a firm that avoids burnout can maintain higher productivity year-round, so investing in employees’ well-being is seen as financially wise.

- Economic Factors and Industry Trends: Broader economic factors influence accounting firm revenues and thus pay. For example, high interest rates or tax law changes can spike demand for certain services (e.g., tax consulting, restructuring advisory), leading firms to offer one-time bonuses in those busy areas or hire specialists at premium pay. Conversely, if there’s an economic downturn, firms might shift to a higher variable-compensation mix (to protect their costs) – meaning lower base salaries but higher potential bonuses tied to performance. The current environment, however, shows robust demand for accounting services, so most firms are opting to invest in higher pay now to ensure they have the capacity for client work. The idea of a “vibecession” – pessimistic vibes despite a decent economy – hasn’t reduced accounting salaries; if anything, it has made firms double down on retention through compensation because they feel the talent pinch more acutely in a pessimistic narrative.

Putting It All Together: Key Takeaways

- Base vs. Production Pay Mix: In U.S. public accounting, base salary is typically the largest portion of compensation, but performance-based pay can contribute 10–30% (or more) of total earnings in a good year. For staff and seniors, bonuses might be a smaller percentage (5-15% of base), whereas for partners, the majority of income might be variable (profit share, bonuses based on firm results).

- Firm Size Differences: Large firms offer higher absolute pay and tend to have structured bonus programs (often firm-wide profit bonuses and merit increases). Small firms might negotiate more individualistic deals (like paying a percentage of billables or giving sizable bonuses for client work). However, small firms may not always offer big bonuses – some instead pay a “premium” base salary and no bonus to keep things simple.

- Role-Based Expectations: Audit and tax professionals expect heavy emphasis on billable hours – their path to higher pay is often through more hours or promotion to higher-billing roles. Advisory and consulting roles (including managerial accounting projects) might see more project-completion or results-based bonuses, aligning pay with successful outcomes rather than just hours. Specialized credentials (CPA, CMA, CISA, etc.) and in-demand expertise (tax law, forensic) can significantly boost one’s pay and negotiating power.

- Market Dynamics: The accounting industry is in flux with technology and workforce changes. Salaries are on the rise (nearly 9% uptick in starting pay projected), showing firms’ commitment to attracting talent. At the same time, innovative pay models are emerging – from commission-based pay for accountants.to team-based bonuses – to align employees’ goals with firm success. Automation is rebalancing what is valued (quality and insights over sheer hours), and economic sentiment reminds firms not to lag in compensation, or they risk losing staff to other fields.

By understanding these structures and trends, accountants and employers can better navigate compensation negotiations. Public accounting may have traditionally been “time-and-materials” in its pay philosophy, but it’s evolving.

Today’s production pay structures aim to reward not just time spent but value delivered – whether measured in billed hours, revenue brought in, or successful project completions – while still providing a stable salary foundation.