The Firmlever Weekly Roundup: Issue #37

The "Firm Exit Minefield" Edition

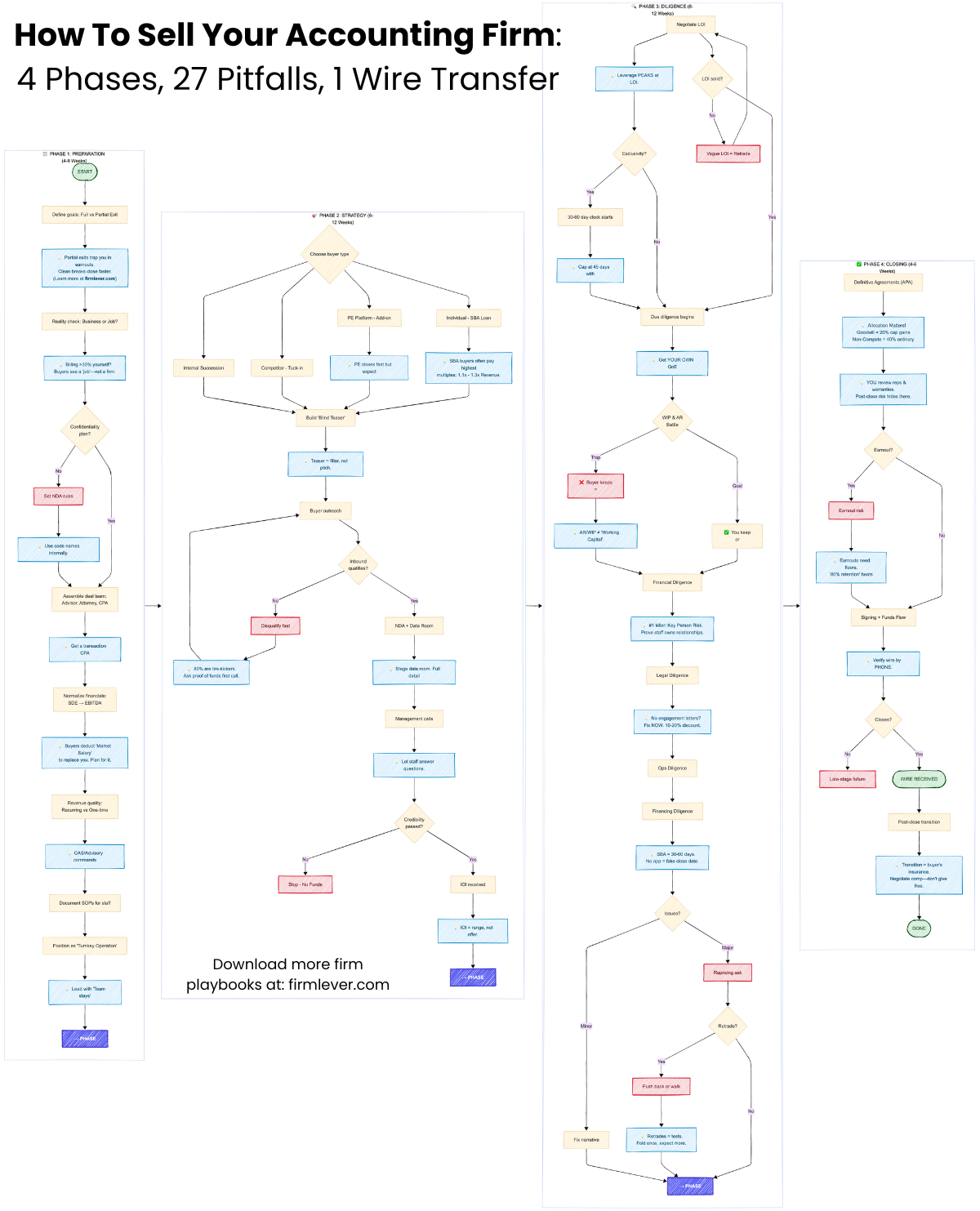

Selling a $1M accounting firm is a minefield.

So I mapped every trap.

The WIP battle that costs sellers $150K.

The "vague LOI" retrade that tanks your price at the 11th hour.

The earnout clause that lets buyers lose your clients--and you eat the loss.

The tax allocation mistake that turns 20% capital gains into 40% ordinary income.

I'm not an M&A advisor.

I don't broker deals.

But I've spent a decade in this industry watching firm owners get outmaneuvered by buyers who've done this 50 times.

So I built the flowchart I wish every seller had before their first NDA.

Whether you've attempted to sell your firm and got stuck, are considering selling your firm someday or have no plans to sell your firm anytime soon but want a playbook just in case.

This playbook is for you:

It covers:

- The 4 buyer types (and which pays the highest multiple)

- The "Key Person Risk" test that kills deals

- The diligence landmines and how to defuse them

- The leverage points most sellers never use

Reply to this email with "unlock" if you want the full high-res PDF playbook + my personal notes.

Best,

Marc

p.s.– Thanks for all the responses to last week's newsletter about my Accounting Firm M&A Deal Stack. I decided to take an extra week to update for the new resources that I came across. For those who expressed interest I have you noted and apologies for the delay--looking forward to sharing soon!