The Firmlever Weekly Roundup: Issue #35

The "Show Me The Money" Edition

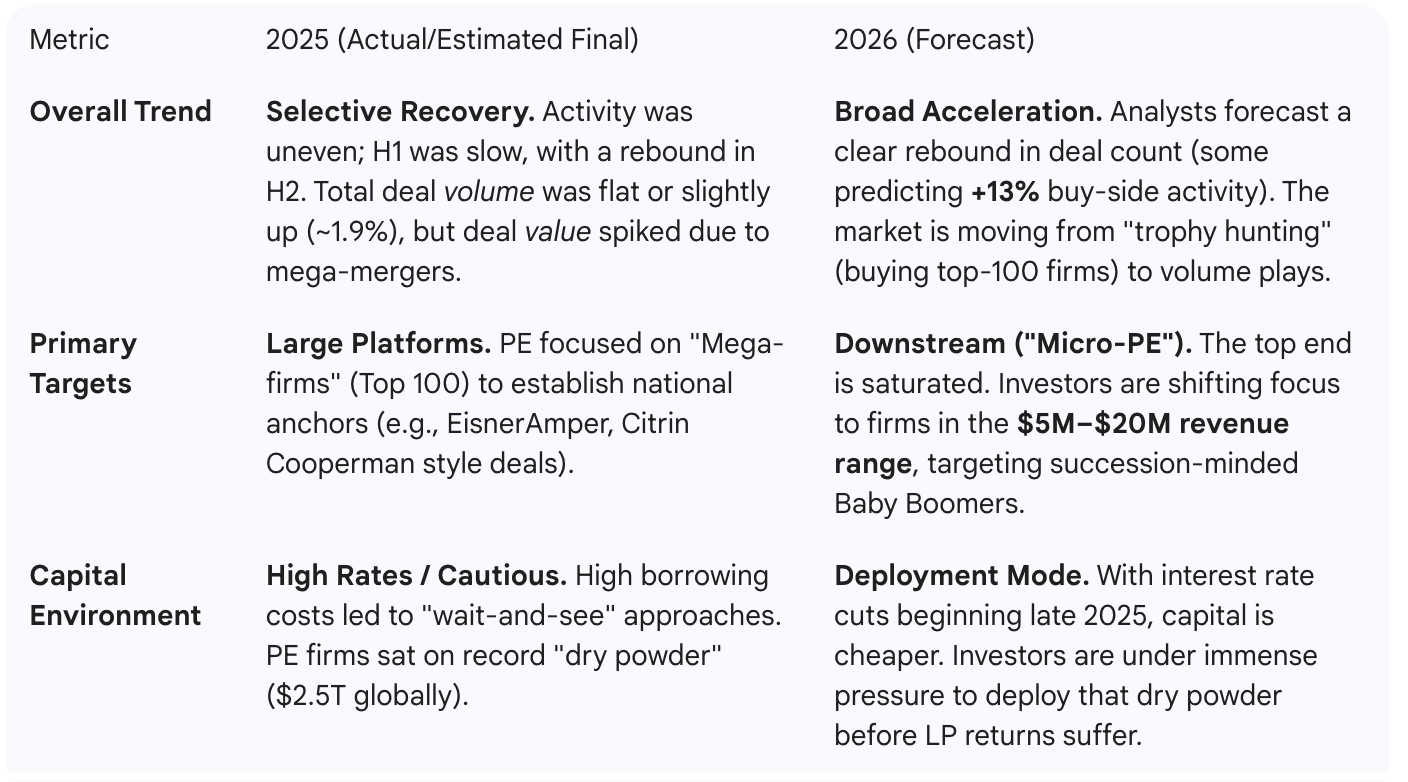

I'm seeing an uptick in accounting firm transactions this year.

And deal flow is moving deeper to the lower middle market (LMM):

A split market is emerging. Firms with proprietary IP (workflow tools, AI audit layers, client dashboards) are decoupling from the "1x revenue rule".

- Tech-enabled firms: Projected to command 2.0x – 2.5x revenue (valued closer to SaaS companies).

- Traditional firms: Will likely remain at 1.0x revenue or lower, viewed as "fixer-uppers" needing heavy infrastructure investment.

- The "IP" Premium: Buyers are no longer just buying cash flow; they are buying code. If you have an automated process that can be stripped and deployed across a PE platform's other 50 firms, your valuation skyrockets.

But which LMM firms are the most valuable? Without getting into valuation gymnastics it's the firms that are run as a business, not a practice.

These are the firms where an owner (or partner) can take a two or three week vacation without checking email or vm.

This week I'm tackling this head-on.

Let's dive in...

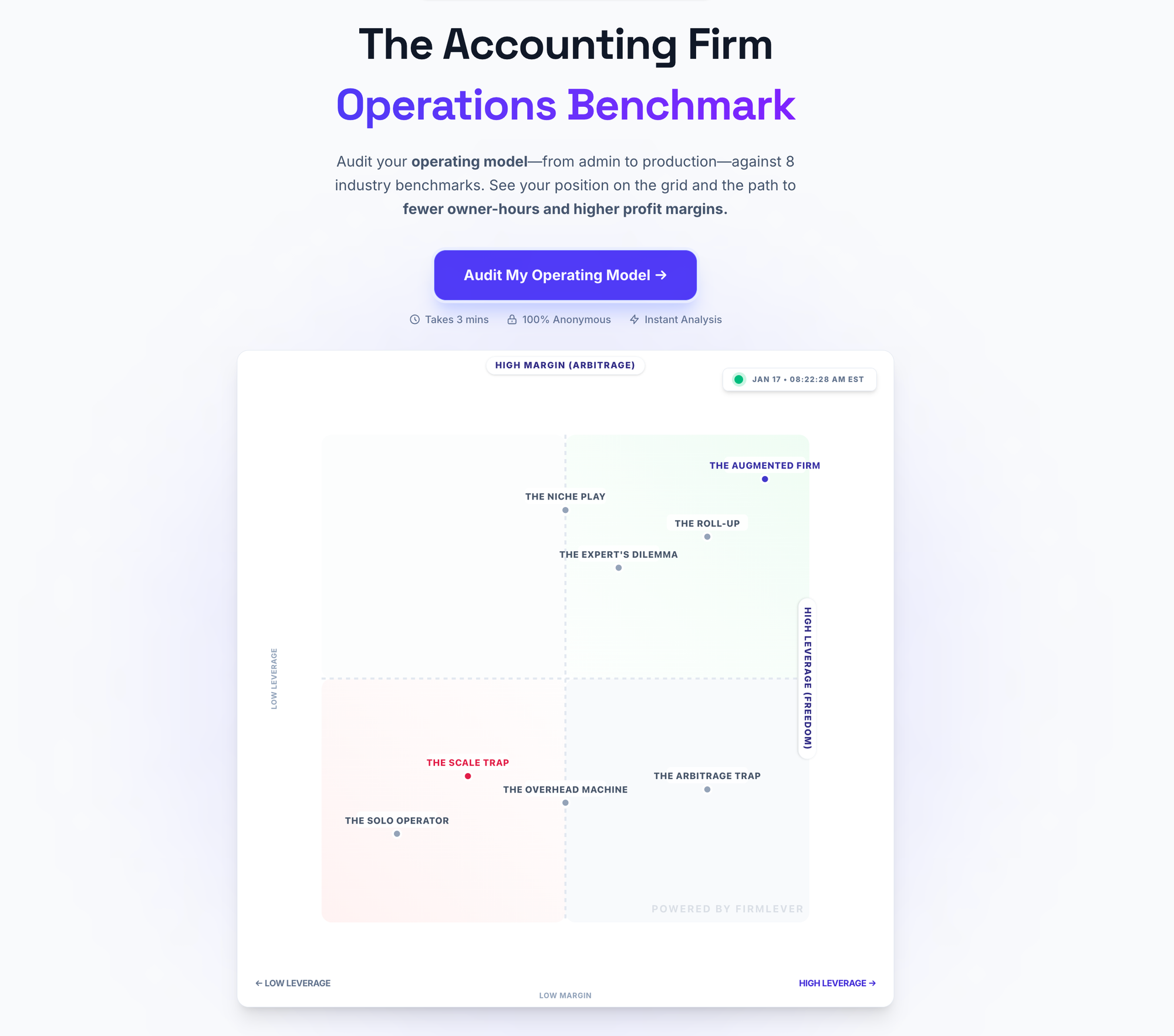

- A new tool to reveal where partner time is leaking. I've updated the Firmlever Do The Work tool to evaluate firms that are ripe (or not) for maximum valuation. Not that they are planning to sell. I mean why sell if you're netting 30%+? Sure, maybe you want to cash out a few chips, but from a cashflow perspective these firms are being run like mini tech platforms with dwindling owner involvement (we'll save the attest vs non-attest CPA model debate for another Saturday).

- Introducing: A Pay-for-Performance Accounting Firm Growth Model

I'm launching something different in our growing Firmlever ecosystem. Based on the survey from last week where I asked:

Which TWO of these feel most urgent for your firm right now?

(A) "Extract more profit from what I've already built"

(B) "Get the firm running without me as the bottleneck"

(C) "Know what I'm actually sitting on — my firm valuation and exit options"

(D) "Grow faster through acquiring another firm or book"

(E) "Find a path forward that isn't just grinding indefinitely"

The majority of responses were for B and E. So I'd like to test a model I'm working on.

For the next 5 firms, I'll personally rebuild your pricing, cull your dead-weight clients, and optimize your owner take-home—and you pay nothing unless it works.

Here's the deal:

- I audit your firm revenue model, service lines, client base and pricing

- We identify the gaps (pricing, mix, utilization, owner hours)

- I build a 30-day execution plan

If I don't improve profit or reduce owner hours, you owe me nothing.

This will be a hands-on implementation with my skin in the game.

I'm limiting this to 5 firms because I'll be in the weeds with you—restructuring engagements, writing the price-increase emails, building the client transition scripts.

Ideal fit:

- $500K–$3M revenue

- Know you're underpriced but haven't pulled the trigger

- Have clients you should've fired years ago

- Working more hours than you want for less than you're worth

- Buried in compliance work vs. advisory

Not a fit:

- Already optimized and just want validation

- Not willing to fire or reprice underperforming clients

- Looking for software, not execution

Taking 5 firms. Reply "DIAGNOSTIC" and I'll give you the details (no obligation).

5 spots. First come, first served.

Opportunities and Deal Flow:

My partner has the following deals just in--if you or anyone you know would be interested, just shoot me a note:

Deal #1: Two separate UHNW-focused tax practices that are open to strategic transactions with a wealth management firm (one seeking acquisition and the other seeking a strong minority investment):

- Ideal buyer: WM firm with $1B–$10B AUM

- Target firm size: 50–150 professionals

- Focus: HNW and UHNW clients

- Bonus consideration: CEO or Managing Partner with significant licensing, certifications, and deep industry experience

- Geographic flexibility nationwide

Deal #2: $500K Florida accounting/CFO firm with construction niche for sale

- Seeking buyer

- Ideally with construction industry focus

That's it for this week!

-Marc

p.s.– Last week I started removing subscribers who have not clicked or responded to any of my newsletters (this kills my deliverability). To make sure that I do not remove you by mistake, please reply "keep". Thanks in advance!