A $1.13M Mid-Atlantic Firm With a $188K/Year Profit Leak

A Firmlever teardown...and why it’s not a “more clients” problem

A Mid-Atlantic CPA firm recently analyzed using compare.firmlever.com (private beta). We’re building a live benchmark database for firms under $5M. Identifying details are anonymized with permission from the owner--the economics are real.

This tear down should've happened years ago.

The funny thing is the CPA firm owner said "this totally makes sense"....yet never gave himself permission to take action.

The good news is that over the next few months we'll be putting the plan into action. (More on this next week).

Let's dive in.

This is a $1.13M, cloud‑native Mid-Atlantic firm with 7 people and 250 clients.

On paper? Strong.

In reality? It’s bleeding $15,694/month in pure profit because the operating system is mispriced and inefficient at the same time.

That’s $188,333/year you’re donating to your clients.

👉 Run your own numbers: compare.firmlever.com (free during private beta).

The baseline snapshot:

- Revenue: $1.13M

- Team: 7 (1 partner, 4 accountants, 2 admin)

- Clients: ~250

- Utilization: 60%

- Effective rate: $129/hr

- Direct cost per hour: $45/hr (includes payroll + software)

- Gross margin: 65% (strong — but not Elite)

- Owner comp: $265,000 (and still working ~60 hrs/week)

Here’s what that actually means:

This owner built a profitable firm — and then got trapped inside the delivery engine.

At $129/hr realized, the firm is running a professional services machine with a retail price tag. Meanwhile, at 60% utilization, capacity is trapped in the system — work stalls, handoffs multiply, and the owner becomes the default router.

In a nutshell:

The Top 3 Operational Moves (from Compare)

Compare gives three practical levers.

These are alternative paths, not something you stack all at once.

- Volume Growth (Client Acquisition): +$14K/mo

- Utilization Boost (+3 points): +$5K/mo

- OpEx Optimization (‑5% of revenue): +$5K/mo

All three work. But for this teardown, I’m not modeling “more clients.”

The firm already has the classic symptoms of being overloaded without being leveraged: low utilization, low realized rate, owner overwork.

Adding more volume on top of that is how you create a nicer top line… and a worse life.

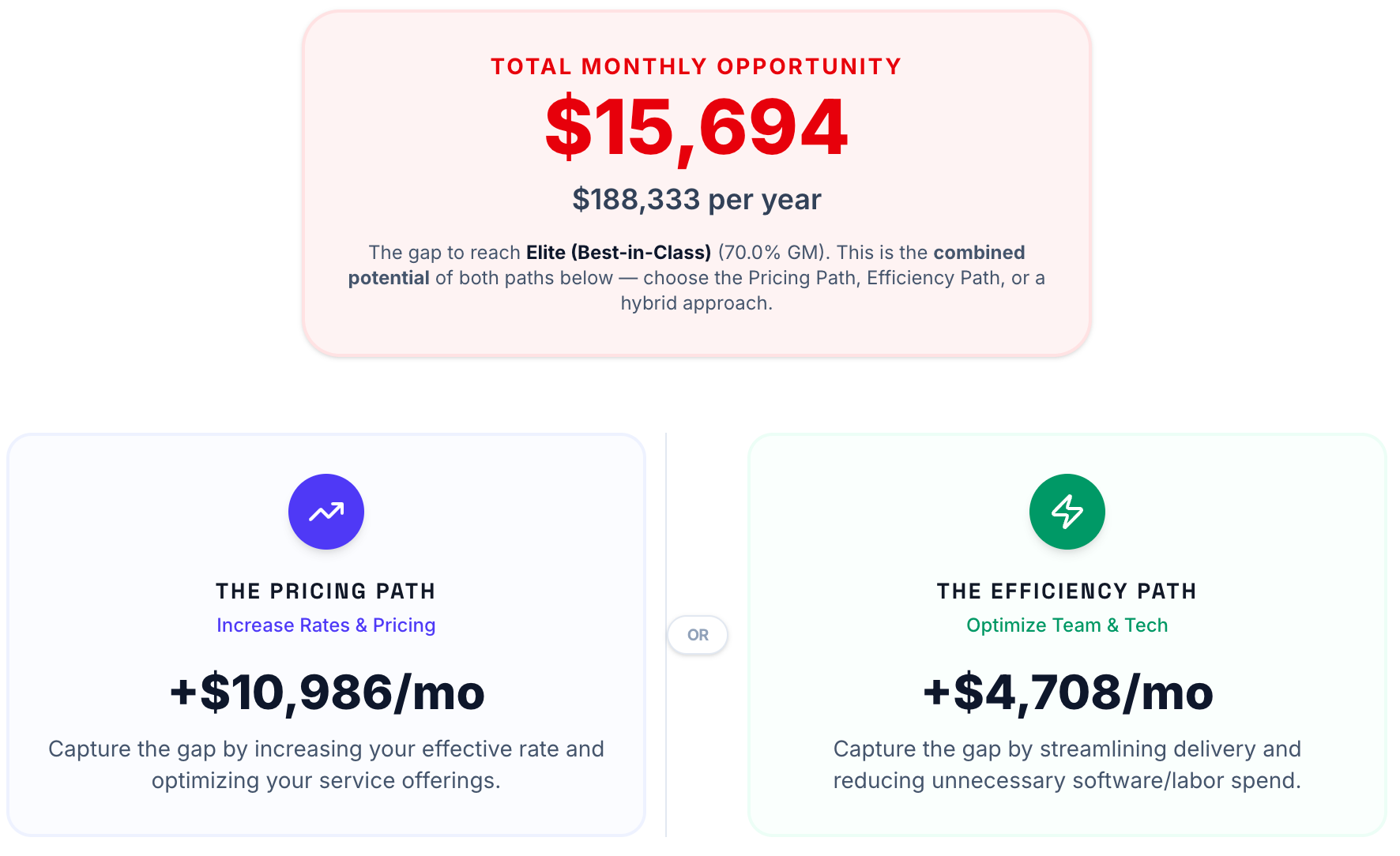

The $15,694/mo opportunity (the only part that matters)

Compare breaks the profit gap into two paths:

- Pricing Path: +$10,986/mo

- Efficiency Path: +$4,708/mo

Combined: +$15,694/mo.

This is the clean story:

This firm doesn’t need a new niche. It doesn’t need a new tool. It doesn’t need more clients.

It needs to stop under‑realizing its hours and stop paying for workflow friction.

BEFORE: Income Statement (Actual)

| Before | Annual | % of Rev |

|---|---|---|

| Revenue | $1,130,000 | 100.0% |

| Cost of services (direct labor + production software) | $395,500 | 35.0% |

| Gross Profit | $734,500 | 65.0% |

| Operating expenses (overhead) | $339,000 | 30.0% |

| Operating Income | $395,500 | 35.0% |

| Owner compensation (partner) | $265,000 | 23.5% |

| Net Income | $130,500 | 11.5% |

This is what “good numbers / bad life” looks like.

The owner is paying themselves $265k, but the firm only throws off ~$130k after that--which is why the owner can’t truly step back.

The owner is doing too much of the work that the system should be doing.

AFTER: Income Statement (Modeled from Compare recommendations)

This model does not assume hiring.

It assumes two things:

- Pricing path: the owner closes the realized‑rate gap (packaging, minimums, offer design) and captures +$10,986/mo.

- Efficiency path: the firm removes waste in delivery + tech + admin burden and captures +$4,708/mo.

| After | Annual | % of Rev | Δ vs Before |

| Revenue | $1,261,832 | 100.0% | +$131,832 |

| Cost of services (direct labor + production software) | $395,500 | 31.3% | $0 |

| Gross Profit | $866,332 | 68.6% | +$131,832 |

| Operating expenses (overhead) | $282,504 | 22.4% | ‑$56,496 |

| Operating Income | $583,828 | 46.3% | +$188,328 |

| Owner compensation (partner) | $265,000 | 21.0% | $0 |

| Net Income | $318,828 | 25.3% | +$188,328 |

That delta is the entire game: +$15,694/mo.

(Compare rounds this to $188,333/year; the monthly numbers above annualize to $188,328.)

What actually changes (without pretending you “overhauled the firm”)

Here’s exactly what was recommended to earn that $15,694/mo:

1) Pricing Path (the $10,986/mo)

- Raise your price floor on the work that generates the most interruptions (85% personal return mix is a classic offender).

- Cull or re‑price the bottom slice of clients who generate most of the “quick questions.”

- Package the repeatable work into clear tiers so you stop renegotiating scope every week.

- Move more clients into recurring (the firm is at 15% today; stability fixes utilization because it reduces chaos).

That’s how realized rate goes up without adding hours.

2) Efficiency Path (the $4,708/mo)

- Standardize the delivery process so work doesn’t stall waiting for the partner.

- Reduce tech overlap (most firms with a “robust stack” are paying twice for the same function).

- Push admin work up the funnel (better intake, better document capture, fewer back‑and‑forth cycles).

That’s how margin comes back without cutting quality.

3) The owner problem (the part nobody wants to admit)

This report is basically calling you out:

If the owner is working 60 hours/week, the firm isn’t short on effort.

It’s short on leverage.

Pricing + efficiency is how the owner buys time back.

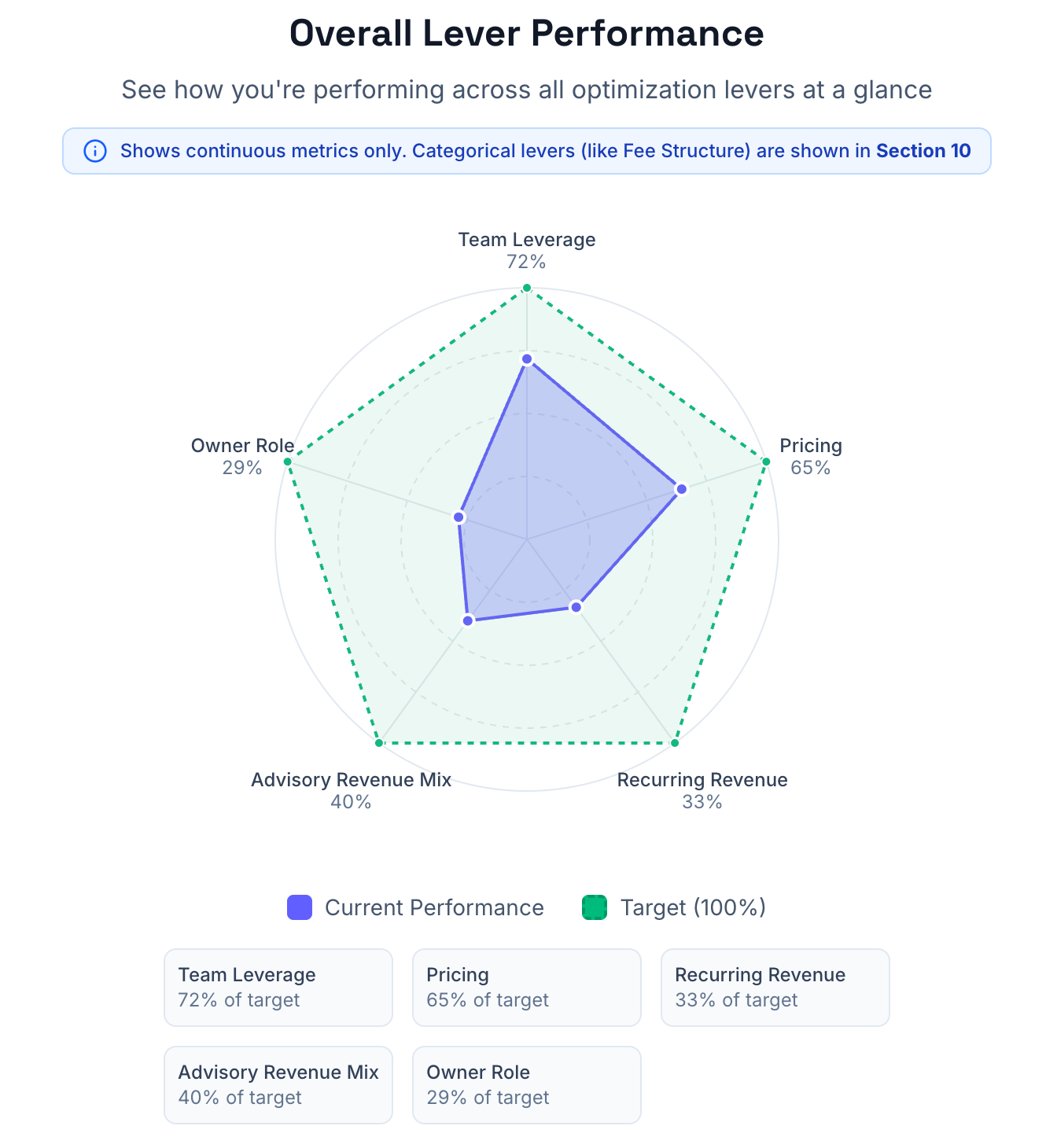

The full report is quite long and helps visualize where you are compared to your recomended target:

The firm is already strong. Gross margin is already high.

But the difference between “good” and “Elite” at this band is simple:

- Stop under‑realizing hours (pricing)

- Stop paying for friction (efficiency)

That’s $15,694/mo.

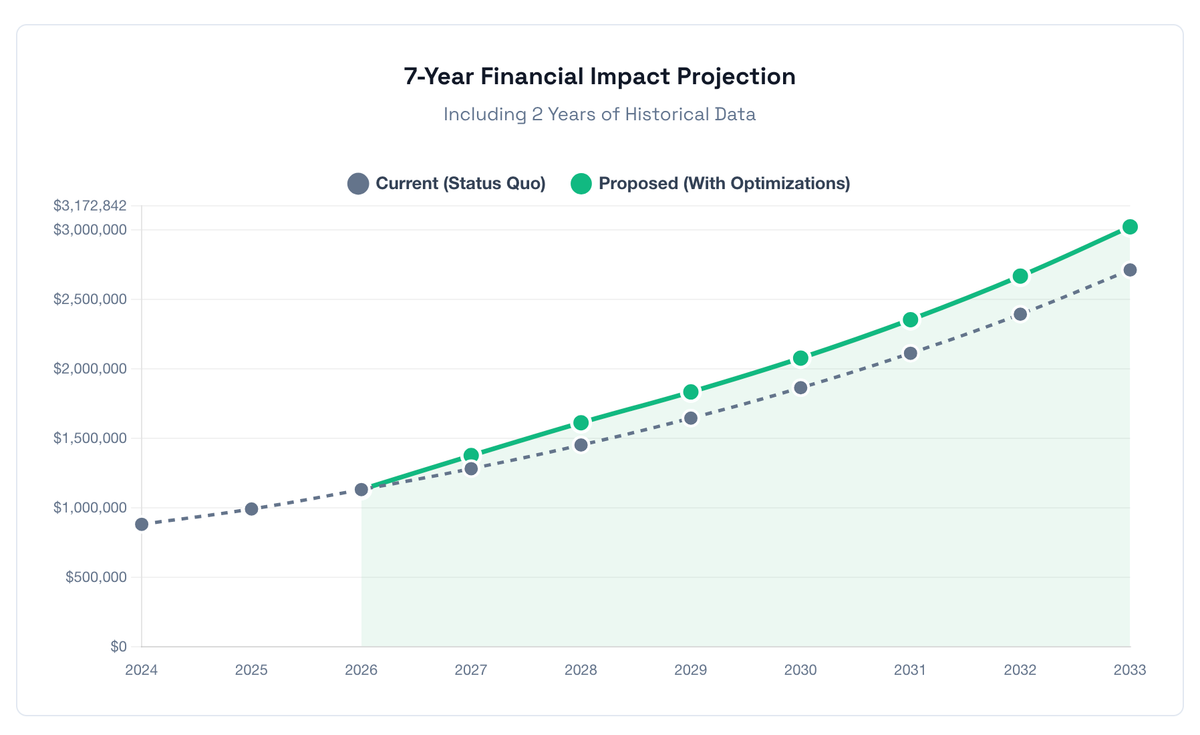

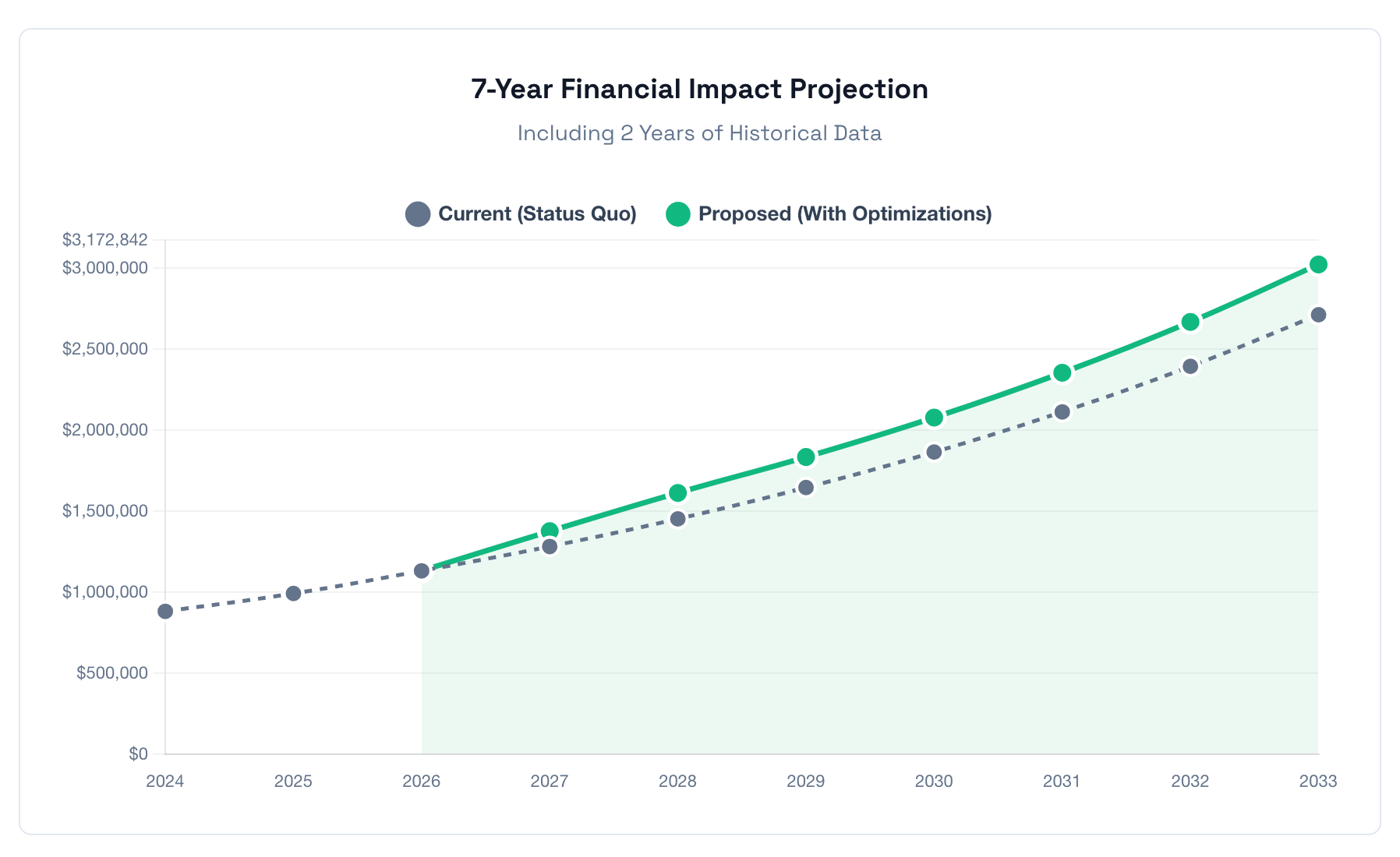

Over 7 years?

Want your own number — your own “Cost of Doing Nothing” — and a clean comparison to other firms in your revenue band?

It takes less than 5 minutes.

You’ll get:

- Your baseline economics (effective rate, utilization, margin structure)

- How you compare to similar firms (and where you’re leaking money)

- The monthly profit gap you’re leaving on the table

- A short, actionable roadmap to close it